venmo tax reporting 2022 reddit

If a person accrues more than 600 annually in. Starting January 1st 2022 VenmoPayPal and other similar apps must report annual commercial transactions of 600 or more to the IRS.

Zelle Vs Venmo How They Compare Credit Karma

Venmo tax reporting 2022 reddit Tuesday October 11 2022 Venmo PayPal and other payment apps have to tell the IRS about your side hustle if you make more than 600 a.

Irs Reports Transactions From Venmo Cash App Pay Pal More Wfmynews2 Com

Venmo Cash App Paypal To Report Transactions Of 600 Or More To Irs Marketplace

Pros And Cons Of Zelle Paypal Venmo Or Stessa To Collect Rent

New Rule To Require Irs Tax On Cash App Business Transactions Kbak

Paypal And Venmo Taxes What You Need To Know About P2p Platforms Turbotax Tax Tips Videos

The Ipos To Expect In 2022 Reddit Instacart And Others Could Hit Wall Street Marketwatch

Pnc Customers Can T Access Venmo Third Party Payment Apps Whyy

Can I Use Venmo For Business Credit Karma

What Business Owners Need To Know About Filing Taxes In 2022

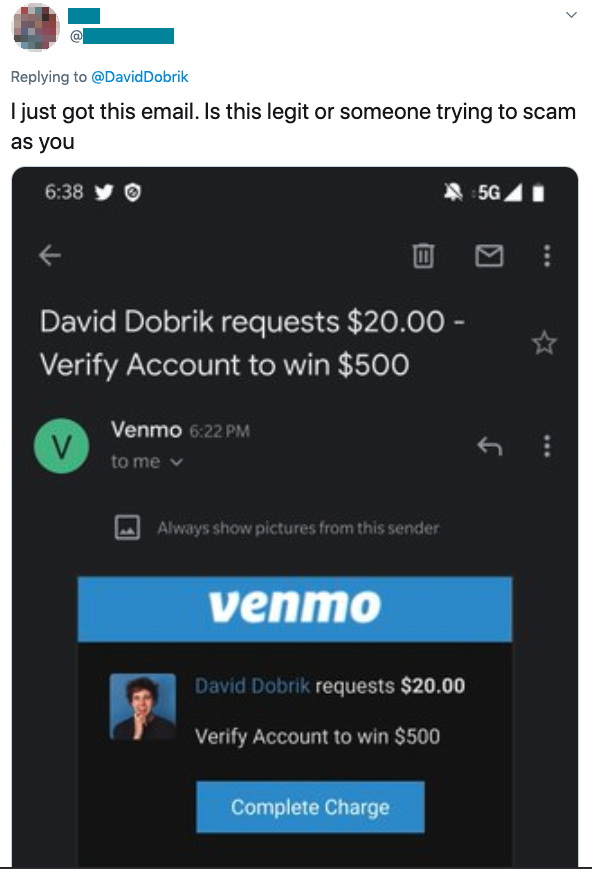

11 Sneaky Venmo Scams Running Rampant Right Now Aura

/cdn.vox-cdn.com/uploads/chorus_asset/file/22686744/GettyImages_1231257842.jpg)

Venmo S New Fees For Goods And Services May Hurt Small Businesses Vox

If You Don T Get Form 1099 Is It Taxable Will Irs Know Hint If A Tree Falls In The Forest

Why Does Venmo Need My Ssn Is It Safe In 2022 Earthweb

Americans Top Brands Of 2021 Shows The Rising Importance Of Fintech

No Venmo Isn T Going To Tax You If You Receive More Than 600 Mashable

Is The Irs Taxing Paypal Venmo Zelle Or Cash App Transactions Here S What You Need To Know

Truth Or Hoax Is The Irs About To Tax Your Venmo And Zelle Transfers Nbc4 Wcmh Tv